Cash isn’t king in China — if you’re confused about the different mobile payment methods in China, check out this handy guide before travelling there!

If you’ve been to China in the last decade, you’d know setting up a WeChat account is essential for making payments. What surprised me on my first trip to China though, was that most stalls (yes, even street food stalls) have QR codes for mobile payment. And while some stalls accept cash, they generally do not carry small change so they still prefer cashless payments like WeChat Pay and Alipay.

Photo credit: Changi Airport Group

For those who’ve attempted/struggled to set up WeChat previously, here’s some good news for Singaporeans. On 19 September 2023, Changi Pay announced its collaboration with the Alipay+ network to introduce a new QR payment feature, which can be used in China!

So if you’re new to payment methods in China, here’s everything you need to know:

Mobile payment methods used in China (WeChat Pay/Alipay/Changi Pay)

Photo credit: Tencent

The two most common mobile payment apps in China are WeChat Pay (微信支付) and Alipay (支付宝), while Changi Pay is a new digital payment option from Singapore. Here’s a breakdown of these cashless payments:

WeChat Pay

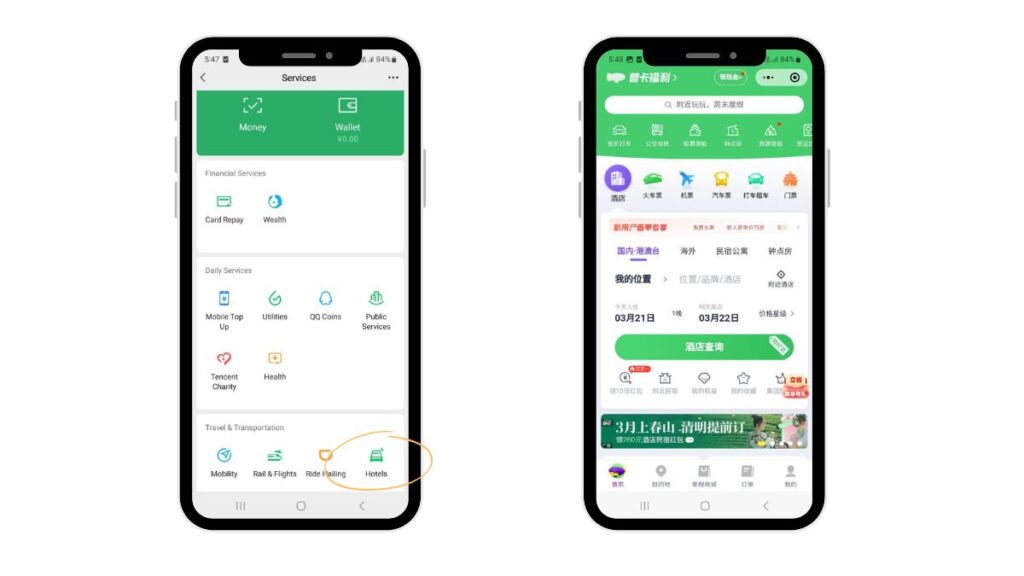

To access it, you’ll have to download WeChat on your phone. It’s a Chinese app that doubles up as a messaging and social media platform, as well as mobile payment (aka WeChat Pay). In-app there are other services like games, booking car rides and buying train tickets.

Alipay

Alipay is mainly an online payment platform, like PayPal! But you can also book hotels and transportation like flights, trains and car-hailing rides through the platform. There’s even a tool which translates Mandarin to other languages like English, Bahasa Melayu and Japanese!

[NEW] Changi Pay

Changi Pay is an in-app cashless payment method within the Changi App — which lets you check flight updates in real-time, pre-book attractions and find your way around Changi Airport and Jewel Changi Airport. Psst, it has all you need for your China trip in a single app: Changi Airport and flight information, promotions, and overseas payment!

Photo credit: Changi Airport Group

Here’s a quick overview of the differences between the three apps 👇

| App | WeChat Pay | Alipay | Changi Pay |

| Language | English and Mandarin | English | English |

| Exchange Rates | Determined by the issuer of linked credit cards | Determined by the issuer of linked credit cards | Determined by the Service Partner, Alipay+ |

| Transaction Fee | 3% for single transactions above 200RMB (~S$37) | 3% for single transactions above 200RMB (~S$37) | None |

| QR Supported | Supports WeChat (green sign) | Supports Alipay (blue sign) | Supports Alipay in China, and Alipay+ QR codes in other countries (blue sign) |

| Payment | – Linked credit card | – Linked credit card – Tour card (e-wallet) | – Liquid Account (e-wallet) topped up via PayNow |

Language

While all three apps have an English interface, WeChat Pay is a bit more challenging to navigate. AKA, you’ll have to use some functions in Mandarin when travelling in China (cries in han yu pin yin).

For instance, on the home page you’ll see that the range of “Services” are in English. But once you click on some of them, like “Hotels”, it immediately switches to Mandarin — panic mode on. So yes, unless you have an A in Mandarin, I’ll hit B for “back button”.

Exchange Rates

The exchange rates for both WeChat Pay and Alipay are determined by the issuer of your linked credit cards, so it depends on which card you use.

However, for Changi Pay, the exchange rate is provided by Alipay+. You’ll be paying the SGD equivalent based on the exchange rate reflected on the app but don’t worry, you won’t incur fees from using the service!

Transaction Fee

Shoppers, you’ll want to read this very carefully. WeChat Pay and Alipay charge 3% for single transactions above 200RMB (~S$37) — which isn’t too hard to hit if you are a self-proclaimed shopaholic (guilty as charged) 😭

You could spend in separate transactions to avoid this, but if you don’t want to do the math, here’s an alternative with no transaction fees — Changi Pay!

QR Supported

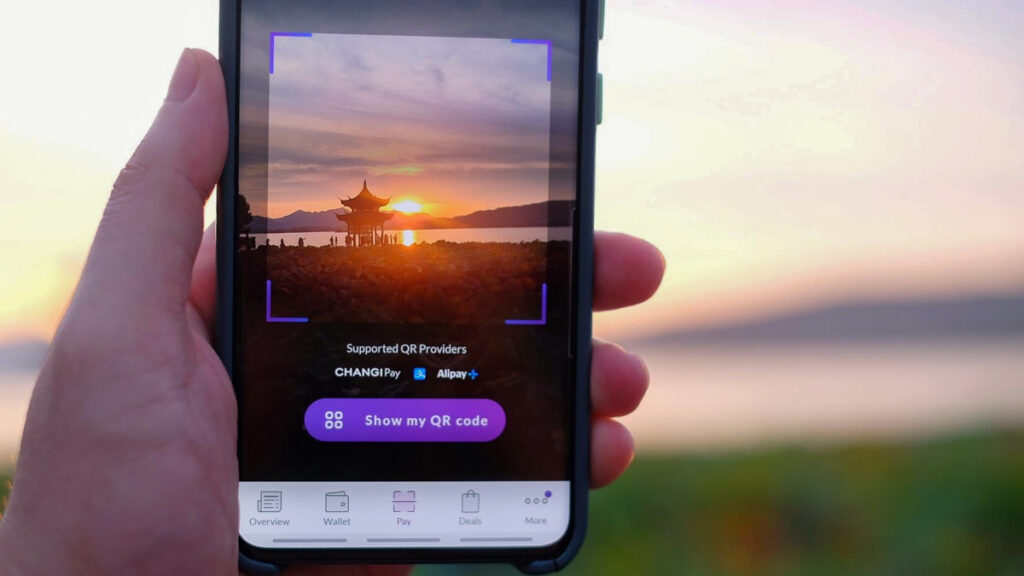

Photo credit: Changi Airport Group

To make payment in China via mobile, use the app to scan the merchant’s QR code. Look out for signs like the ones above. WeChat Pay is in green and Alipay/Alipay+ is in blue.

For Changi Pay, you can use the app to scan any Alipay+ enabled merchants. This includes countries outside of China like Malaysia, Macau and more countries that will be added soon. Just scan the merchant’s QR code or show your own Changi Pay QR code to the merchant and you’re good to go!

Payment

Photo credit: Changi Airport Group

For payments in China via WeChat and Alipay, you can link your international credit cards directly to the app. Both apps support cards such as VISA, MASTERCARD, DINERS CLUB INTERNATIONAL, DISCOVER, and JCB.

*Note: WeChat also supports AMERICAN EXPRESS (AMEX) but Alipay does not.

Besides the credit card option, Alipay also has an in-app function called “Tour Card”. It works like a digital wallet, where you’ll have to top-up to pay with one-time generated QR codes. There’s a limit of 10,000RMB (~S$1,870) though, with a 5% service charge for each top-up. Each Tour Card has a validity period of 90 days.

WeChat has a digital wallet too but you can only top it up with a China bank account or bank card. This is mainly used for transferring funds between WeChat users. So you don’t need to use this method because you can directly pay merchants via the linked credit card in the app!

Photo credit: Changi Airport Group

For Changi Pay, you’ll need to sign up for a Liquid Account (similar to an e-wallet) and top it up via PayNow (capped at S$999 per top-up). Your Liquid Account can only hold up to S$5,000 at any given time and there’s a maximum spending limit of S$30,000 on a rolling 12-month basis. Unlike the Tour Card on Alipay, there’s no validity period for the Liquid Account 🥳

FYI, while you can’t top up Changi Pay with a linked credit card for overseas payments, you can still use it for local payments at Changi Airport/Jewel Changi and on the iShopChangi website.

Read till the end for the step-by-step on setting up Changi Pay!

*Note: Here are the transaction limits for payments in China via the Alipay+ network

– Payment by static QR (scan QR code and key in amount) — 500RMB (~S$94) per transaction and 50,000RMB (~S$9,349) in a year

– Payment by dynamic QR and merchant scan (don’t need to key in amount) — 7,000RMB (~S$1,309) per transaction and 70,000RMB (~S$13,089) in a year

Factors to Consider

So now that we’ve gotten a gist of what these apps offer, how do we know which is the best one to use? You might want to consider these factors first!

Verification

For WeChat, there are a few verification methods required when setting up your account. For example, through your phone number, asking friends in your WeChat contacts to send you a code, photo of your passport etc (it ain’t called the Great Firewall of China for nothing 😅).

Speaking from experience, both WeChat Pay and Alipay will also prompt you to verify your identity once every few days via mobile number. On my previous trip to Hainan, I had a hard time with verification because I had no local mobile number. So I couldn’t verify my identity to use the ride-hailing app and make payments (there’s no option for cash payment either).

Thankfully I managed a workaround by using a friend’s phone number instead and asked her to send the verification code to me, if not I would’ve probably been stranded on the streets 😭

Whereas for Changi Pay, you only need to verify your identity via mobile number once to activate your Changi Pay digital wallet and register for a Liquid Account. After you’ve successfully registered, there’s no other mobile number verification prompt when using the app.

Security

Photo credit: Changi Airport Group

The Liquid Account sign-up for Changi Pay is within the Changi App, signed in with your Singpass. This ensures that your personal details are safe and secure. Whereas for the other two apps, it’s manually keyed in and saved in-app.

Functionality

The good thing about WeChat and Alipay though, is that you can book car-hailing services, train rides, flight tickets and hotel rooms within the app, while Changi Pay mostly functions as a payment method in China.

But honestly, this isn’t really an issue because you can still book these items separately on various platforms like Klook, Booking.com, Skyscanner etc — with occasional promotions and deals too!

You can also request ride-hailing services via WeChat or Alipay, and pay with Changi Pay if the driver has an Alipay QR code for you to scan.

Perks of using Changi Pay for cashless payment in China

Photo credit: Changi Airport Group

Personally, for someone who can’t speak or read Mandarin well and shops (A LOT), Changi Pay sounds like a really great traveller-friendly payment in China. Here’s a recap of the perks:

– It’s in English

– You can use it across tens of millions of Alipay+ enabled merchants who accept Alipay in China

– It has competitive exchange rates

– No transaction fees for any amount spent! Reminder: WeChat and Alipay charges 3% for single transactions above 200RMB (~S$37)

– You don’t need to have a China bank account or a Chinese bank-issued credit card

– Better personal data security with Singpass for verification

– Users can top up their Liquid Account via PayNow wherever they are

– For every S$500 accumulative overseas spend, you can earn S$50 Changi Pay e-Vouchers and use them to offset your duty-free purchases at Changi Airport Terminals when you’re back in Singapore 🛍️🍷

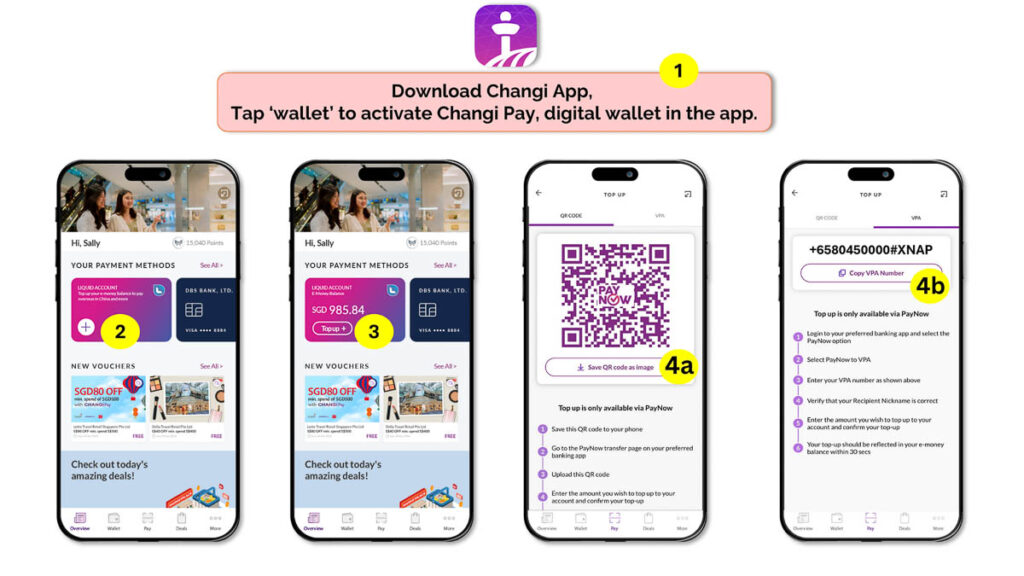

How to activate your Changi Pay digital wallet

1) Download the Changi App and tap ‘wallet’ to activate your Changi Pay digital wallet.

2) Set up your Liquid Account in the Changi Pay Overview Page by tapping on the “+” sign.

3) Select the “Top up” button either on the Overview Page or Wallet Page in Changi Pay.

4a) Save and upload the QR code to your preferred banking app via PayNow.

4b) Alternatively, copy the VPA number and top up via the VPA option in your preferred banking app.

Photo credit: Changi Airport Group

To make payments, tap “Pay” in the Changi App and a QR code reader will appear. Scan the Alipay QR Code presented by the cashier (or let them scan your Changi Pay QR code) and the final amount will be shown in Singapore dollars.

Read also: 10 Essential Apps You Must Have for Travelling in China

Any other questions on how foreigners can pay in China or how to use these cashless mobile payment apps? Let us know in the comments below!

This post was brought to you by Changi Airport Group.