Travelling has taught me many things, but the greatest lesson I’ve learnt is to never scrimp on travel insurance.

During a work assignment to Australia some time back, I fell off a moving segway (don’t ask how) and ruptured my ACL. The road to recovery is slow and painful, but almost going bankrupt from the high medical bills that came after truly shocked me.

Thankfully for me, the trip was covered by travel insurance, and life got back to normal pretty fast. That said, here are 8 reasons why we should all get travel insurance.

8 Reasons to Be Covered by Travel Insurance

1) You save on medical expenses overseas

A friend of mine got into a car accident in the USA, and due to the severity and location of the crash site, had to be airlifted to the hospital. The chopper ride alone was US$10,000 and his total hospitalisation fees chalked up to ~US$20,000.

The last thing you want happening on a trip is falling sick or getting injured, but these are often unpredictable. If there’s anything that can alleviate the discomfort, it would be to seek medical attention right away. However, many travellers end up self-medicating instead. It can be scary seeing an unknown medical practitioner but what’s even scarier is the uncertainty of medical fees.

Medical fees, especially for serious injuries, can easily bankrupt you. That is why getting covered with travel insurance is crucial.

2) You also save on medical expenses back at home

Here’s where the story of my Segway misadventure* continues. Upon my return to Singapore, I got my knee in question checked thoroughly. I went for an MRI scan followed by an X-ray scan. Yup, the scans confirmed that I busted my ACL, and suffered some hairline fractures around the shin bone due to the impact. Both scans cost me a whopping S$1,800 — a sizeable chunk of my monthly pay!

Thankfully, I could claim my medical fees— both from Australia and in Singapore — from the insurance company. In all, I managed to claim ~S$1,900 of medical expenses.

DirectAsia‘s travel insurance also covers any follow-up or additional medical treatments back home up to 30 days from return for injuries sustained from leisure activities overseas. No more wailing in pain about how the medical fees will cripple your finances.

*Important note: If you are engaging in extreme sports overseas, do purchase an add-on optional benefit for Extreme Sports and Activities for extra coverage. Refer to DirectAsia’s policy document for types of extreme sports that are covered in their Extreme Sports and Activities optional benefit.

3) You get to recover the value of lost possessions.

One of our videographers lost her luggage on an inter-city train in Portugal. In it were camera equipment, memory cards and hard disks, among other important personal items. She promptly made a police report in Lisbon and then went shopping for fresh clean clothes, new SD cards and hard disks.

Losing baggage overseas or during transit happens more often than you might think. There’s potential mishandling of baggage by airline staff, other passengers mistakenly taking yours, or even theft. Imagine being overseas without your personal belongings with you — no toiletries, no clothes, etc. It’s stressful, and definitely a mood-killer for what’s supposed to be an enjoyable vacation.

While it doesn’t get less stressful losing luggage even if the trip’s covered by insurance, at least you know some of the losses can be recovered thanks to insurance payouts.

4) Pickpocket and petty crime losses are covered too

Petty theft crime stories from Europe have become pretty common amongst friends who have visited. Especially when visiting European cities that see a large number of foreign tourists such as Barcelona, Rome, Athens, and Paris. These pickpockets are really good at their craft, taking away your wallets in broad daylight, often without you even realising.

In Athens, Greece, while rushing to catch our train, one of us was pick-pocketed while lugging our luggage up a staircase. Before we knew it, her backpack was unzipped and her wallet was gone. It happened so quickly we could see the two culprits dashing across the road from where we stood.

We could have given chase but would risk two things. Our safety in case the culprits were armed and most definitely our scheduled train. After making a police report in Greece and filing a claim through DirectAsia’s website, she was able to claim the value of her wallet and the amount of cash that was in the wallet.

5) You can claim lost opportunity costs due to flight delays

Flight delays happen all the time and can really mess up an itinerary. An extended flight delay also means additional accommodation charges at the departure city, foregoing paid guided tours at destinations, and other opportunity costs. Some airlines make it up to passengers with welfare packs such as light refreshments, but not all airlines have service recovery procedures. This is when you’ll be glad to have your trip covered with insurance.

I once had my flight delayed for 23 hours while returning from Switzerland, and was able to claim S$300* from DirectAsia — this covered the additional expenses incurred on an extra day of accommodation, transport and food.

*Flight delays must reach a minimum of 6 hours to be eligible for claims to be made.

6) Reluctance to travel due to terrorist acts is covered too

Acts of terrorism, though rare, happens. No one expected a terrorist attack on the busy streets of Melbourne, Australia, but it happened as recently as Nov 2018. As someone who frequents Australia, news of the attack shocked me. It’s normal to want to cancel or postpone a trip after news of terrorist attacks in the country of your intended trip. I was never more relieved that my travels are covered with DirectAsia’s comprehensive policy.

Presently, DirectAsia’s travel insurance covers cancellations, curtailments or amendments of an intended trip affected by terrorism that occurred within 30 days to the trip. For travellers who are going to countries with a higher risk of terror attacks, you should really consider this! A trip could easily cost over S$3,000, and that’s how much you do not have to watch go to waste if you choose to cancel it due to acts of terrorism.

Another good practice would be to do a quick check on MFA on the intended country of visit at least a month before the departure date, on the latest updates in countries experiencing unrests.

7) You don’t have to suffer alone overseas

If you got into an accident overseas and are being hospitalised for over five consecutive days, you can claim the expenses required for a family member to fly over and take care of you. The policy covers both the cost of airfare and accommodation of one person to travel to you while you’re under medical attention. While we did not actually experience anything similar, we’d imagine how crucial and comforting it’ll be to have a loved one with us in times of need.

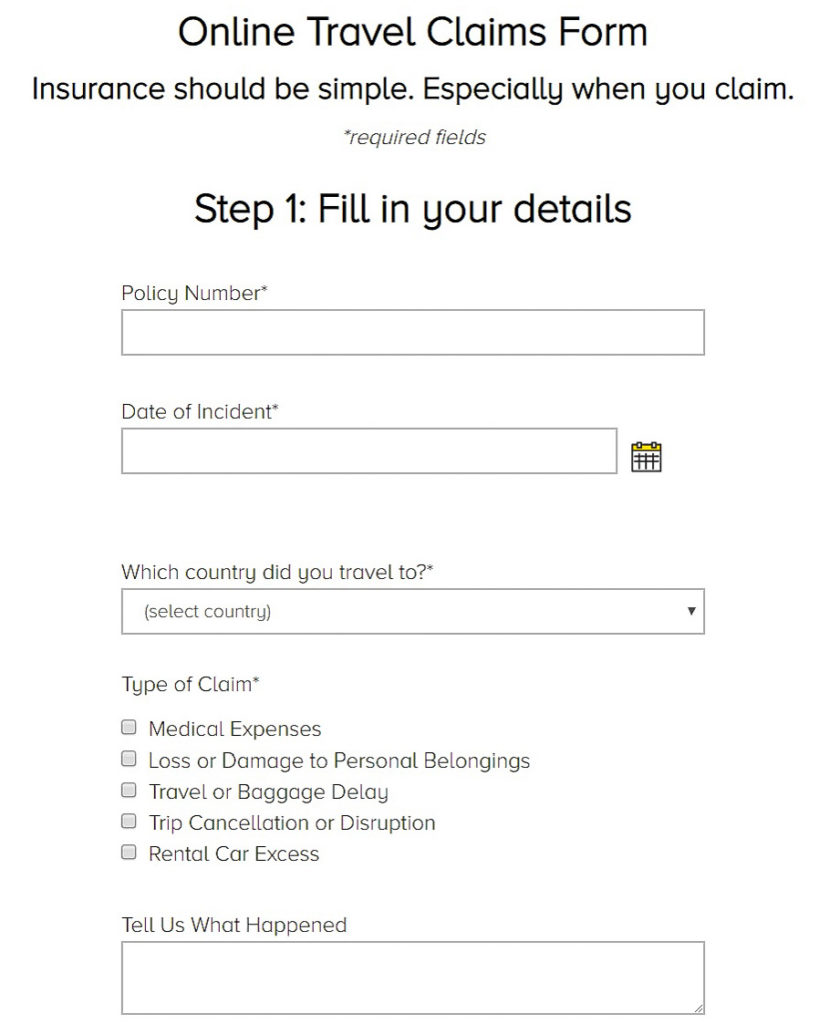

8) Filing claims are not as difficult as you think

Do not let cumbersome purchasing and claiming processes of travel insurance hinder you from travelling with a peace of mind. DirectAsia‘s one-stop website has everything you need from quotation to purchasing to even filing of claims, shall you require them.

My experiences with DirectAsia have been pleasant, and I really have to commend their level of customer service and speed of claims. Our flight delay claims were easily filed online via DirectAsia‘s comprehensive webpage. DirectAsia’s 24/7 claims support guarantee also means you’ll get your claims attended to, expedited, and resolved faster. In fact, more than 80% of claims are settled within 24hrs. Within a week, we received our claim cheques.

Gone were the days when you have to physically meet up with an insurance agent to learn more about travel insurance policies, and then have them pressure you into purchasing more policies with them. Insurance should be something that safeguards and protects you, not something that shuns you from it.

Travel Insurance FAQ

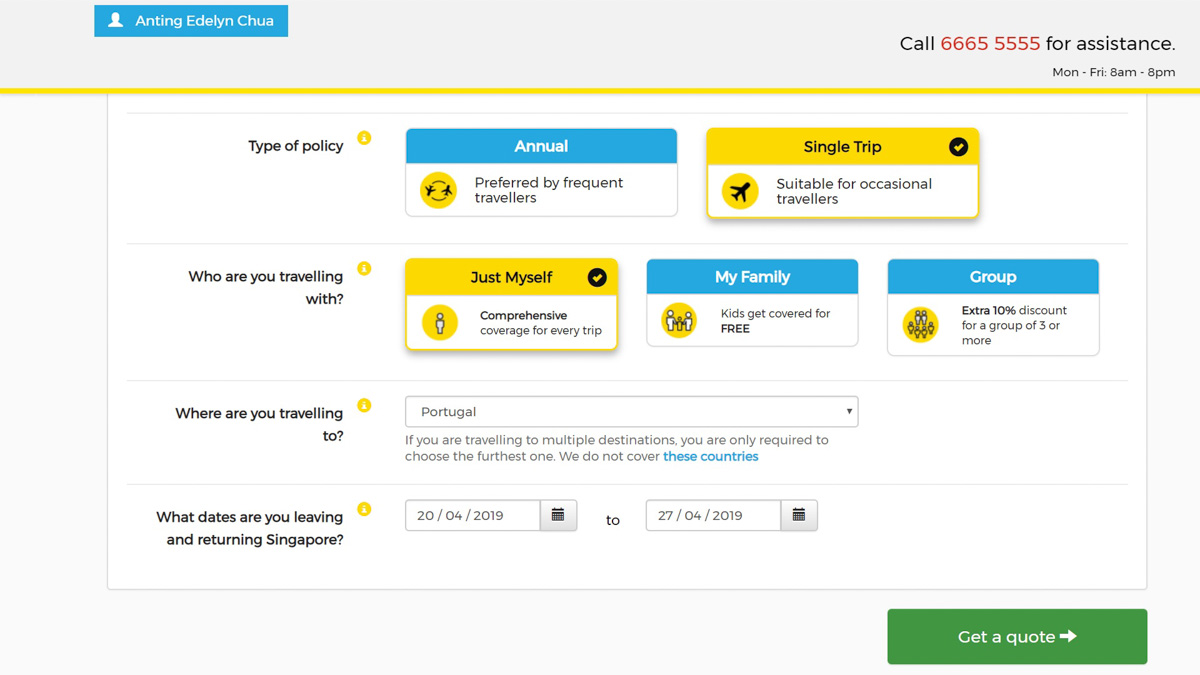

Single Trip or Annual Coverage?

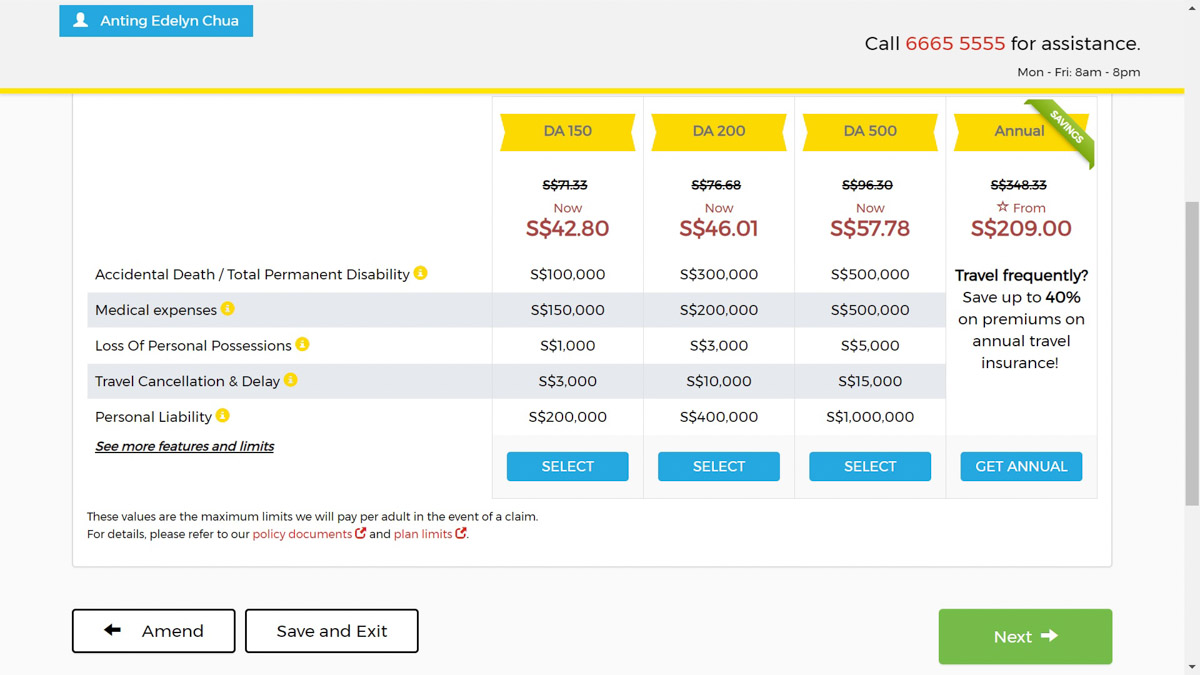

If you fly more than thrice a year, our advice is to get annual insurance coverage just to save on the hassle of repurchasing every time you travel. Depending on your travel zone and coverage tier, an annual travel insurance premium can range between S$149 to S$288.

Which insurance tier should I get?

Our advice is to go with the tier that comfortably covers your possessions’ value (i.e. if you’re travelling with high-value belongings like professional camera equipment.)

If you’re going for a short 3D2N trip to Bangkok and are travelling light, there’s no need to spend more money on higher coverage when your possessions won’t be worth relatively much (i.e. you can’t claim more than what you’ve lost). Always consider how much loss you will incur in the worst case scenario, and choose the tier that covers an equivalent amount.

If you are going to engage in extreme sports such as skiing, bungee-jumping or skydiving with a licensed operator, you’ll need to get additional coverage for extreme sports and activities. DirectAsia also has added optional coverage for sports equipment such as skis, snowboards and scuba equipment.

Where and how do I purchase travel insurance?

Purchasing insurance has gotten a lot easier now that everything can be done online. At DirectAsia, get a quotation online in less than a minute for the coverage plan that fits your travel itinerary and needs the most, before actually purchasing it.

How long should I be insured for?

Your travel insurance coverage should always start from the day you depart to the day you arrive back at home. For example, if your flight itinerary shows departure time from Hawaii at 11AM on Monday (1 Jan) but your arrival back in Singapore is 1AM on Wednesday (3 Jan), you’ll have to get your insurance coverage that ends on Wednesday (3 Jan). You’ll want the insurance to cover until the point your luggage comes out. This is a travel pro-tip that more should know of!

When should I buy travel insurance?

It’s recommended to get your travel insurance after booking your trip to cover unexpected events that may affect your trip.

What supporting documents do I require when filing a claim?

When filing a travel claim, here’s what you need to have and do:

– Have actual copies of flight itineraries

– Letter or statement from airlines proving flight delay (if applicable)

– Make a police report and get a copy of the report (for lost or stolen items)

– Medical reports and receipts (for overseas medical claims)

– Receipts from accommodations showing that trip has been extended due to a flight delay

More Travel Insurance Tips!

In some countries, there is no option to purchase zero-excess insurance. What that means is, you will be liable up to a certain amount should there be costs incurred from vehicle damage. DirectAsia’s rental car excess allows you to claim up to S$1,500 so that helps to cover any excess that the car insurance will not cover. (Do note that this is only applicable if a comprehensive motor insurance has been purchased)

In case of any injuries sustained overseas, get it checked immediately at a clinic or hospital. There’s no reason why you should wait till you get back to Singapore to seek medical help when it’s covered by travel insurance. If you’re feeling unwell immediately after a trip however, your bills are also covered within 48 hours of returning. Do note that DirectAsia’s travel insurance does not cover pre-existing conditions.

Get Coverage that Best Suits Your Needs

Whether you’re an occasional or frequent traveller, travel insurance is a necessity that should never be scrimped on. While understanding and choosing the right travel insurance policy may still seem complicated, with a provider such as DirectAsia that provides their services online, travel insurance is made simpler!

For full details on policy tiers and insurance coverages, do refer to DirectAsia’s policy document.

Note: Edited for clarity after a reader pointed out a couple of contentious phrasings.

This post was brought to you by DirectAsia.

Follow us on Instagram, Facebook, and YouTube for more travel inspiration!

View this post on Instagram

“The chopper ride alone was US$10,000 and his total hospitalisation fees chalked up to ~US$20,000. But my friend was able to walk out of the hospital without paying a single cent as his travel insurance took care of that.”

Are you guys implying that DirectAsia pays upfront? If it isn’t DirectAsia, which insurance company pays upfront, would totally love to purchase from that company

Hey Ben, thanks for pointing out. We have made a mistake and have edited the post so that it isn’t misleading. To clarify, you are right that the policyholder would have to pay first.

The policyholder would also need to contact DirectAsia for authorisation. More details can found above!