We’re not gatekeeping any of these credit card travel hacks!

As a Millennial who’s been adulting for a while, I treat myself to nice getaways occasionally. One thing I do is maximise my credit cards’ rewards system — be it miles accrual for flight redemptions or getting rebates from my spending. Yet, I’ve come to realise this is something that really confuses the Gen Zs of today. Miles? Rewards? What?

Yes, understanding and differentiating the varying perks of so many credit cards on the market can be very overwhelming. So I’ve decided to share some lesser-known credit card travel hacks for newbies!

1) Bulk purchase essentials and big-ticket items online

My first credit card hack is to take advantage of upsized rewards on online spending. This is something quite a few credit cards are gearing towards. For some, the difference can be 10 times of offline spending — for example, the Citi Rewards Card awards 10X Points per S$1 spent for most online transactions.

So, if you have big-ticket purchases that require a significant financial commitment (car, luxury items, or even household appliances), get them online instead of in physical stores. This makes a difference if your goal is to rack up miles, as higher spending = higher rewards.

Other credit cards with higher mile per dollar (mpd) on online spending:

| Credit Card | Benefits |

| Citi Rewards Card | S$1= 10X Points for online & shopping (S$1 = 1x Point for all other transactions) |

| HSBC Revolution Credit Card | S$1 = 10X Points for online & contactless spending (S$1 = 1x Point for all other transactions) |

| POSB Everyday Card | 10% rebate for online food delivery on Foodpanda and Deliveroo 5% for online spending on e-commerce sites Amazon.sg, Lazada, Qoo10, Shopee, RedMart and Taobao |

| DBS Live Fresh Card | 6% cashback on all online and app spending (0.3% on other spends) |

| DBS Woman’s World Card | S$1 = 10X miles for online spending (S$1 = 1x Point for local offline spends) |

| OCBC Frank Credit Card | 6% cashback on all online and app spending (0.3% on other spends) |

A sweet hack I recommend is to use Instarem’s amaze card for all offline transactions. Every eligible offline transaction on the amaze card will be converted to online transactions — more miles and cashback earnings!

TL;DR, Instarem is a money-transfer service with lower foreign currency conversion fees and competitive exchange rates. The amaze card is Instarem’s multi-currency card that allows users to make payments via linked Mastercard credit/debit cards or stored funds in the e-wallet. More about it at the end!

2) Get free lounge access at airports

Most credit card travel hacks aren’t secrets but are often forgotten, such as this one — free access to airport lounges!

This used to be a privilege for First and Business-Class flight passengers, but quite a few credit card companies now include lounge access as an exclusive benefit to their customers. It’s a nice perk when you have a long layover and are looking for a quiet place in the airport to relax before hopping on your flight. Plus, most lounges serve complimentary food and drinks too!

Below are some entry-level credit cards that come with free lounge access benefits:

| Citi PremierMiles | 2 Visits per year to the Priority Pass Lounge |

| DBS Altitude Visa | 2 Visits per year to the Priority Pass Lounge |

| AMEX HighFlyer Card | 2 Visits per year to the Priority Pass Lounge |

| HSBC TravelOne Card | 4 Visits per year to the DragonPass Lounge |

| AMEX KrisFlyer Ascend | 4 Visits per year to the Plaza Premium Lounge |

Putting this into a dollars-and-cents perspective, pay-per-use lounges in Singapore Changi Airport cost S$55 per 3-hour slot. Something to remember the next time you’re at an airport 😉

Read also: 7 Actually Interesting Things to Do in Singapore for Overseas Friends on a Layover Flight

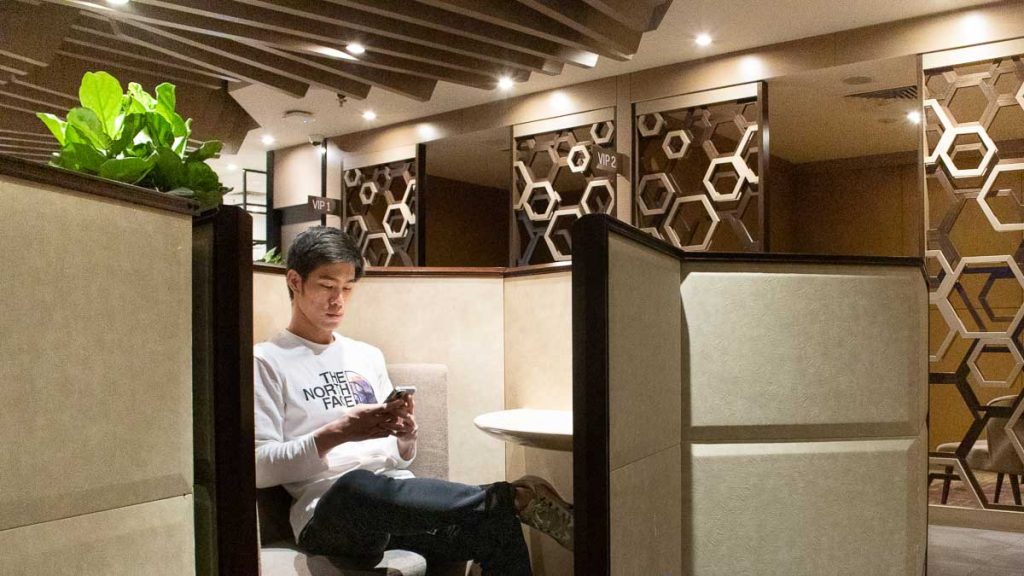

3) Make payments in local currency when spending overseas or on foreign websites

Here’s a money-saving hack not many are aware of. When shopping overseas or buying things from a foreign website, always pay in the local currency, not your home currency. This reduces the chances of lousy FX rates or having hidden fees such as the Dynamic Currency Conversion (DCC) on top of your bill.

For context, DCC is a payment option that allows buyers to pay in their home currency when they make overseas transactions. It may seem like an obvious choice at first as it reflects a currency you’re familiar with. And you’ll know the cost without having to calculate the currency conversion.

But in reality, it’s always charged higher than regular bank FX, allowing merchants to take a cut of the transaction too. The difference in charges is usually 3% to 7% higher. On top of that, you might still have to pay a foreign transaction fee to your credit card provider — you’ll only know when you receive the bill at the end of the month 😱

So for me, I always use my Instarem amaze card when I’m making a transaction in foreign currency.

Instarem converts foreign currencies into SGD before charging the amount to the linked credit or debit card. The FX rate will be based on Mastercard’s exchange rate, which is also typically lower than some credit card companies.

*Pro-tip: If you don’t own any Mastercard credit cards, you can still use the amaze card to pay by topping-up funds into the amaze wallet on the Instarem app. Payments with amaze wallet funds won’t incur FX fees for foreign currency transactions!

*Note: The maximum amount that can be stored in the amaze wallet is S$5,000 or equivalent in foreign currencies. It’s free to top up your wallet with PayNow or a Mastercard; a 1.5% fee will be charged for Visa.

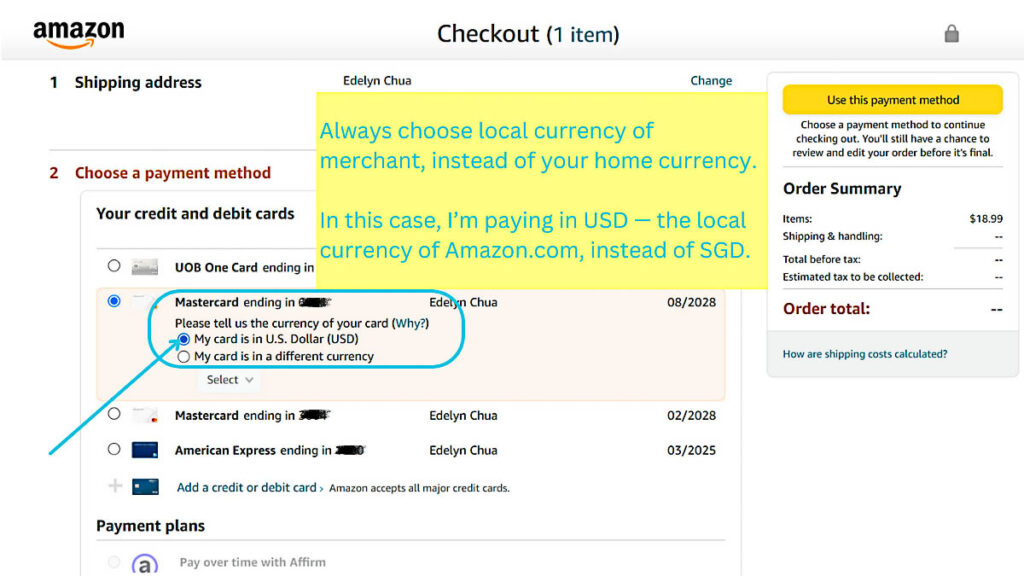

4) Use the Instarem app to figure out what earns the most miles

If you are serious about collecting miles, you should hold a specialised credit card that earns miles at higher mpd than regular cards. However, some have restrictions such as only rewarding miles for certain payment methods and merchant categories, or having a cap on the bonus rewarded.

The Instarem app allows users to check Merchant category codes (MCC) of transactions easily.

Here’s where the next travel credit card hack comes in. The Instarem app allows users to check the Merchant Category Code (MCC) of transactions easily, showing the corresponding four-digit code on the transaction itself. Credit cards like the OCBC Titanium Rewards Credit Card and the Citibank Rewards Card have upsized rewards for certain merchants only, hence knowing the MCC will be really helpful in maximising rewards from future purchases!

5) Score travel deals like free travel insurance, discounted airfares, and more

Another perk that credit card holders are entitled to but often overlook is scoring exclusive travel deals from credit card companies or payment networks such as Mastercard or Visa. Some include discounted airfares, hotel deals, complimentary travel insurance coverage, and more!

^Also applicable for amaze cardholders

Tabulated information is accurate at the time of posting and is subject to change. Do check with your credit card company for the latest updates.

Read also: Best Adventure Travel Insurance for Thrill-Seekers (2023)

6) Earn extra cashback on top of primary benefits

As mentioned, I’m a seasoned Millennial (read: aunty) — a stereotypical kiasu Singaporean. I look out for extra perks beyond what my existing credit card gives.

It’s like getting discounts on apparel brands by accumulating loyalty points, or a free cute plushie from your favourite sushi restaurant on your 24th visit.

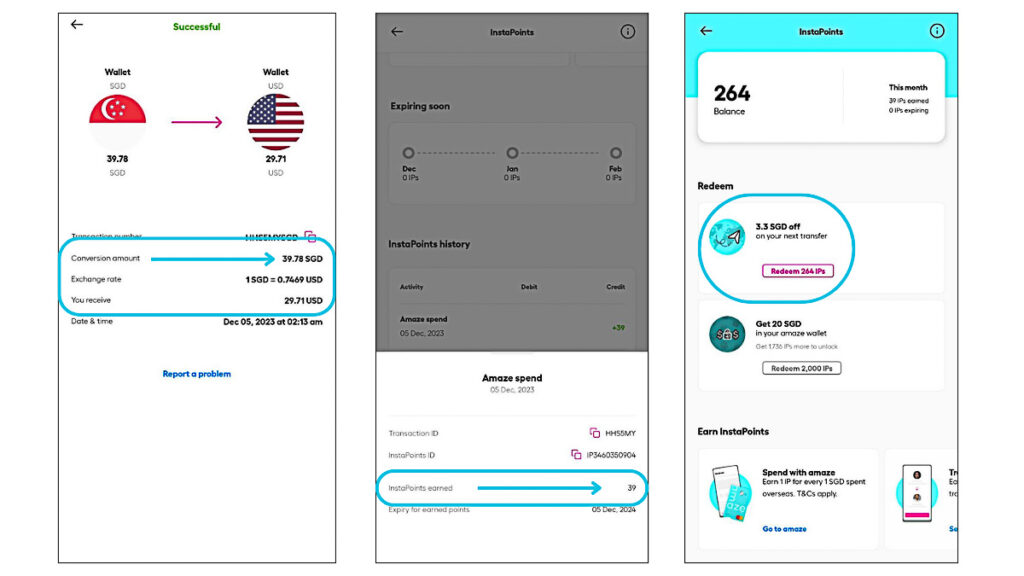

I earned 39 InstaPoints instantly after making a US$29.17 (or S$39.78) purchase on Amazon.com using my amaze card and wallet.

So, whenever I shop online on a foreign website, I’ll pay with my amaze card. Instarem’s rewards system lets users earn InstaPoints on top of the rewards given by the linked credit cards. This is the same for when you make transactions overseas too.

Every S$1-equivalent spent via the amaze wallet earns 1 InstaPoint, while every S$1-equivalent spent via the amaze card earns 0.5 InstaPoints on foreign currency transactions of at least S$10.

The InstaPoints earned can then be used to redeem items on the Instarem app, such as discount vouchers for money transfers (80 InstaPoints = S$1) or cashback (2,000 InstaPoints = S$20)!

New to Instarem and the amaze card?

Confusing T&Cs of travel credit cards aren’t going to go away anytime soon, so heed this aunty’s advice for what works if you want a fuss-free (and literally, free) way to earn more benefits while you spend.

So, back to Instarem — an online money transfer service that’s extremely useful for frequent travellers and strategic spenders. The app allows users to send money from Singapore to more than 60 countries with competitive exchange rates and lower foreign conversion (FX) fees compared to traditional bank rates!

To start:

– Download the easy-to-use Instarem app

– Sign up for an Instarem account via SingPass

– Apply for the amaze card on the app

Psst, promo deets below!

Unlike most credit cards, the amaze card has no minimum income requirement and no annual fees. You can also use the virtual card immediately while waiting for the physical card to be sent out 😎

Here’s a summary of the Instarem amaze card’s mechanics and benefits:

1) Links up to five Singapore-issued Mastercard credit or debit cards — no need to carry around many physical credit cards or make additional top-ups 😜

2) Converts foreign currency to SGD before being charged to linked card — based on Mastercard’s exchange rate

3) Able to see Merchant Category Code (MCC) on transactions — to maximise the air miles collected for certain cards

4) Earn additional rewards on top of linked credit card rewards — redeem InstaPoints for cashback or to offset money transfers

And if you don’t hold a Mastercard credit or debit card, you can also top-up funds into the amaze wallet on the Instarem app (with 0 FX fees for transactions in foreign currencies)! It also functions as a multi-currency account — convert SGD to foreign currencies when rates are favourable, and hold onto them till it’s time for your trip!

TTI Exclusive Promo:

The first 1,000 new Instarem users can get a S$10 reward in the form of 1,000 InstaPoints!

To be eligible for the reward, follow these simple steps:

– Download the Instarem app

– Sign up for an Instarem account with referral promo code <INTERN>

– Apply for the amaze card

*Pro-tip: Verify your particulars via Singpass to get your account set up in minutes!

Offer ends 31 December 2023. InstaPoints will be credited within 7 days from the end of the offer period.

Know of other travel credit card hacks? Share them in the comments 🙂

This post was brought to you by Instarem.

Like what you see? Follow us on Facebook, Instagram, YouTube, and Telegram for more travel inspiration!

@thetravelintern #miles #airmiles #traveltips ♬ Off The Record (Sped Up) – IVE