I get it, insurance seems like a scam sometimes. But trust us when we say it’s saved our butts countless times.

On a trip to Europe, one of us had our entire backpack stolen… and then a few weeks later, another had their phone pickpocketed in the same country.

While losing your personal belongings can be traumatising (especially your phone), knowing that we had insurance to cover our losses was a huge sigh of relief.

What more when you’re planning for an adventurous trip? Scuba diving, hiking over high altitudes, climbing, or even skydiving!

Since we’re huge advocates of chasing adventures, we decided to also dig in a little to research on the most fitting adventure travel insurance to cover you sufficiently for your trip!

Best overall adventure travel insurance plan (2024)

Our list is based on factors including: benefits, coverage of activities, variety & affordability of plans, and reliability.

Take note that we are specifically prioritising insurance for thrill-seeking activities. These plans may not be the best ones if you’re looking for other things like baggage loss, trip cancellation, etc.

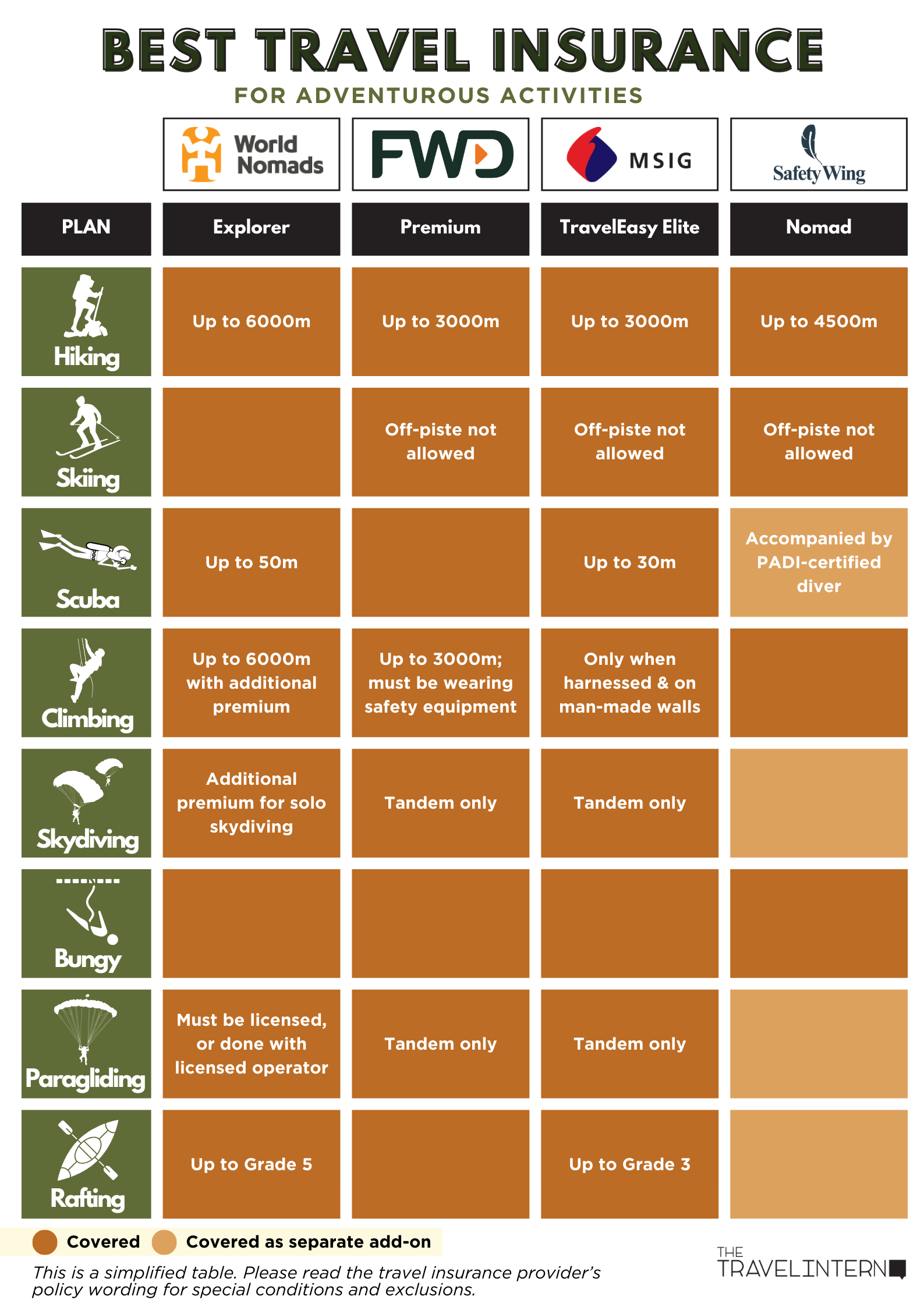

World Nomads (Explorer) | FWD (Premium) | MSIG (TravelEasy Elite) | SafetyWing (Nomad)

Best travel insurance for hiking

Planning an epic hike up Everest Base Camp? Annapurna Circuit Trail? Or perhaps K2?

Most of the basic travel insurance providers do not offer coverage for hiking at altitudes exceeding 2000m but here are some options if you’re planning to do so!

| Provider | Plan | Coverage | Highlights |

| World Nomads | Explorer | Up to 6000m | – Unlimited medical expenses – Medical transport (US$500K) |

Global Rescue | High-Altitude Evacuation Package | Above 6000m | – Membership basis only – Includes field rescue and medical evacuation (no additional cost) |

| FWD Insurance | Premium | Up to 3000m | – Medical coverage (S$200K) |

Best travel insurance for skiing and snowboarding

If you’re going for winter adventures like snowboarding/skiing or even sledding, check if your travel insurance provider covers these activities. On top of that, most travel insurance providers do not cover off-piste skiing, which involves going beyond the designated official boundaries of a certain location.

| Provider | Plan | Coverage | Highlights |

| FWD Insurance | Premium | No known limit | – Medical coverage (S$200K) |

| MSIG Insurance | TravelEasy Elite | Within resort only. Off-piste not included | – Accidental death ($200K) – Overseas medical expenses ($500K) |

| World Nomads | Explorer | Off-piste allowed | – Unlimited medical expenses |

Best travel insurance for scuba diving

Travel insurance providers generally require you to be with a licensed professional to qualify for scuba diving insurance, and only have coverage up to a certain depth.

If certified, you’ll only reap insurance benefits if you dive within your current qualification limits. Lastly, free diving does not fall under scuba diving.

| Provider | Plan | Coverage | Highlights |

| FWD Insurance | Premium | No depth limit | – Medical coverage (S$200K) |

| MSIG Insurance | TravelEasy Elite | Up to 30m | – Accidental death ($200K) – Overseas medical expenses ($500K) |

| World Nomads | Standard | Up to 30m, but can be upgraded to 50m | – Medical expenses (US$5M) |

Best travel insurance for rock climbing

Some insurance providers only cover climbing on man-made walls and/or if you’re wearing a harness. They may be strict when it comes to the location — indoor or outdoors, accessibility, etc.

Also, mountaineering is usually a separate activity from traditional rock climbing.

| Provider | Plan | Coverage | Highlights |

| MSIG Insurance | TravelEasy Elite | – Only when harnessed – Only man-made walls | – Accidental death (S$200K) – Overseas medical expenses (S$500K) |

| World Nomads | Explorer, additional premium needed for outdoor climbing | – Up to 6000m – Soloing prohibited | – Unlimited medical expenses – Emergency medical evacuation |

| FWD Insurance | Premium | – Up to 3000m – Must be wearing safety equipment | – Medical coverage (S$200K) |

Best travel insurance for skydiving

Most travel insurance providers make a distinction between solo skydiving, and tandem skydiving. For the latter, they require the activity to be managed by a licensed operator.

| Provider | Plan | Coverage | Highlights |

| World Nomads | Explorer, with additional premium for solo skydiving | Solo and tandem skydiving included | – Unlimited medical expenses – Emergency medical evacuation |

| MSIG Insurance | TravelEasy Elite | Tandem skydiving only | – Accidental death (S$200K) – Overseas medical expenses (S$500K) |

| FWD Insurance | Premium | Tandem skydiving only | – Medical coverage (S$200K) |

Best travel insurance for bungy jumping

Most travel insurance providers only cover bungy jumping when you’re doing it with a qualified and licensed operator.

| Provider | Plan | Highlights |

| Etiqa | Tiq Travel Insurance (Entry) | – Overseas medical expenses (S$200K) |

| MSIG Insurance | TravelEasy Elite | – Accidental death (S$200K) – Overseas medical expenses (S$500K) |

| World Nomads | Standard | – Overseas medical expenses (US$5M) |

Best travel insurance for paragliding, hang gliding, and parachuting

Much like skydiving, these activities are usually only covered when you’re doing it in tandem with a qualified and licensed operator.

| Provider | Plan | Coverage | Highlights |

| FWD Insurance | Premium | Tandem paragliding only | – Medical coverage (S$200K) |

| MSIG Insurance | TravelEasy Elite | Tandem paragliding and tandem hang gliding only | – Accidental death (S$200K) – Overseas medical expenses (S$500K) |

| World Nomads | Explorer, with additional premium for hang gliding and paragliding | Paragliding and parachuting: Must be with someone qualified and licensed; or have the needed certification/license at home Hang gliding: Must be with someone qualified and licensed | – Unlimited medical expenses |

Best travel insurance for white-water rafting

Be mindful of the rafting grade you’ll be taking on, as some travel insurance providers don’t cover higher ones. This should also be done with a licensed operator.

| Provider | Plan | Coverage | Highlights |

| FWD Insurance | Premium | No known grade limit | – Overseas medical expenses (S$200K) |

| MSIG Insurance | TravelEasy Elite | Up to Grade 3 | – Accidental death (S$200K) – Overseas medical expenses (S$500K) |

| World Nomads | Explorer | Up to Grade 5 | – Unlimited medical expenses |

How to choose the best adventure travel insurance

Now that you’re familiar with top travel insurance plans that cover extreme activities, here are a few more tips to help you:

1) Read the fine print — Travel insurance policies change regularly! Make sure you read the terms of the agreement/policy wording carefully, and ask any question you may have to the provider before you make a commitment.

Other things to keep an eye out for: coverage for personal accident (accidental injury resulting in permanent loss of limb, disability, or sight), and personal liability (you injure or cause damage to another person).

Read also: I Tore My ACL While Travelling and Travel Insurance Saved Me S$1,900

2) Decide what else you need — Ask yourself if you only want coverage for a single trip, or for long-term. Also consider other things that may go awry during your trip (baggage loss, trip delays and cancellation, etc.) and compare the different plans.

3) Consider other factors — These include ease and speed in processing claims, coverage for any pre-existing medical condition, how many days from purchase before you can enjoy benefits, and regional coverage — the less countries, the cheaper!

Meet like-minded adventurers

Adventures are best experienced with other adventurers! If you love adventures, come join us on the next TTI Experiences — you’ll be part of a community of thrill-seekers like yourself that encourages you to step beyond your comfort zone and create lasting memories.

Any questions about finding the right adventure travel insurance? Let us know in the comments!