Because anything can happen when you’re on the road.

As someone who has been doing remote work since 2019, getting insurance has never crossed my mind until I almost crashed into a family of four while I was riding a bike in Vietnam. Mind you, the last time I touched a bike before that was nine years ago.

Then there was a time I thought I had lost my passport, when my phone got washed away by a huge wave, etc. In short: there were many times I cut it too close. Because the harsh reality of travel is that these things are inevitable.

So when I learned that certain travel insurance plans cover more than physical injury (lost passport and gadget damage), I knew I had to look deeper into them.

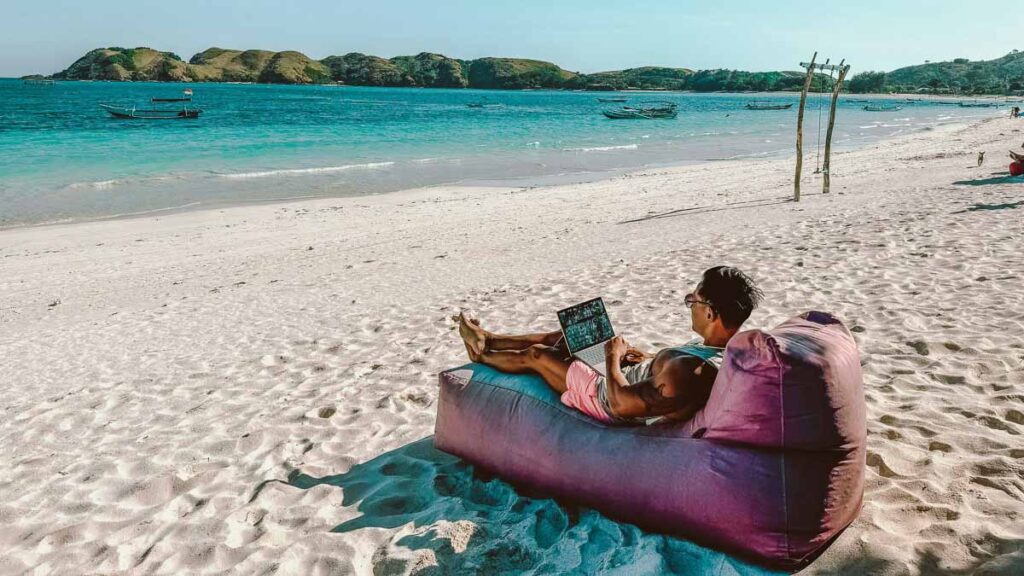

Photo credit: Johnny Africa via Unsplash

If you’re someone who has already decided to take “the leap” and be a digital nomad, then getting the right travel insurance is a must… no matter how overwhelming the process of getting one can be.

Just the peace of mind it’ll give you is worth it 🧘♀️

And to make this transition safer and less intimidating for remote workers, we’ve made a guide to help you choose the best travel insurance!

Basic things to consider for travel insurance

It’s essential to consider the following factors when buying travel insurance, regardless of whether you’re a digital nomad or not:

Special considerations for digital nomads

Throwback to when we tried remote working as part of the Airbnb Live Anywhere programme!

Take note that while any kind of travel insurance is good, having a plan specifically tailored for remote working is highly recommended. Here are some things that you won’t normally find in short-term travel insurance plans (which are imperative for digital nomads):

Duration of coverage: You’ll want an insurance plan that will cover you for a long period of time — whether it’s months, a year, or longer. The option to extend your plan at any time will be helpful in the off-chance that you might extend your travel dates.

Location coverage: The fun in remote work is you don’t know which country you might end up in next! Make sure your insurance plan covers countries you’re hoping to visit, including emergency care.

Equipment insurance: One of the worst things that could happen on a digital nomad’s trip is losing an expensive gadget (laptop, smartphone, etc). So we recommend getting a plan with equipment insurance coverage — especially for those with professional equipment like DSLR cameras and lenses.

Adventure activities and sports: Certain international health insurance providers have plans tailored for more “extreme” physical activities, which aren’t usually covered in basic travel insurance plans. This is something adventurous travellers might want to get if you’re thinking of off-piste snowboarding or deep-level scuba-diving on your off day 😉

Read also: Best Adventure Travel Insurance for Thrill-Seekers (2024)

Medical coverage for short-term vs long-term trips

It’s important to note that basic travel insurance normally only covers emergency medical situations, trip cancellations, and baggage loss/delay — more applicable for short-term trips.

However, what remote workers may be looking for is called international health insurance (or global health insurance) — designed specifically for long-term coverage.

It provides comprehensive medical coverage such as in-patient and out-patient visits, check-ups, etc. Basically, an emergency or accident doesn’t have to happen for you to benefit from this type of plan.

But depending on how long you’ll actually be remote working, you might be okay with the usual travel insurance.

Best travel insurance providers for digital nomads

Photo credit: Sam Lion via Pexels

Now that you know what to watch out for, let’s get to our list of top travel insurance for digital nomads. We primarily picked these based on three things: (1) credibility, (2) coverage, and (3) benefits.

Credibility includes how trustworthy the insurance providers are based on the number of customers who have bought the plan and their satisfaction. So we looked at their scores on Trustpilot, a platform where customers can leave reviews for companies.

Coverage refers to specific things or incidents that are protected or paid for by your insurance policy — like emergency medical situations and outpatient coverage, etc.

Benefits refer to the maximum amount of money you can get if something happens.

Take note that costs vary depending on many factors such as where you’re going, where you’re from, age, travel duration, and pre-existing medical conditions. We recommend getting a quote from the provider to know specifically how much your plan will be.

1) World Nomads — all-around insurance for digital nomads

Photo credit: World Nomads

As their name suggests, World Nomads is tailored for… digital nomads. They only offer two plans which makes buying insurance less complicated.

The Standard plan covers all essential things a remote worker would want: overseas medical expenses, personal belongings (including stolen passports and credit cards), pre-trip cancellation and interruption, and more.

Meanwhile, the more expensive Explorer plan has higher benefit limits and more coverage, such as rental car excess, personal accidents, and coronavirus-related costs during your travel.

World Nomads — General Highlights

| Duration of coverage | Flexible; can extend your plan at any time |

| Location coverage | Covers 140+ countries |

| Equipment insurance | Covers damage for specified electronic equipment, with additional premium |

| Adventure activities and sports | Included, with option for more extreme sports |

| Trustpilot Score (as of May 2024) | 3.4/5 from 2,535 reviews |

World Nomads — Specific Highlights

| Standard (USD) | Explorer (USD) | |

| Emergency medical expenses | US$5,000,000 | Unlimited |

| Medical transport & repatriation | US$500,000 | US$500,000 |

| Pre-trip cancellation | US$5,000 | US$10,000 |

| Trip interruption | US$3,500 | US$5,000 |

| Stolen, lost or damaged baggage | US$2,500 | US$3,500 |

| Loss of stolen passport or travel document | US$500 | US$1,000 |

| Adventure sports and activities (see list) | Included, up to Level 1 activities – can upgrade to higher level if needed | Included, up to Level 2 activities – can upgrade to higher level if needed |

Get a quote for full policy writings of both plans. It only takes seconds!

World Nomads plans cover travel delays.

Other highlights (see full coverage):

– Out-of-pocket hospital expenses

– Emergency dental treatment

– Travel delay

– Money theft (Explorer only)

– Local funeral expenses

2) SafetyWing — budget-friendly insurance for digital nomads

A more affordable travel insurance for digital nomads is SafetyWing. For example, their Standard Plan for me (a 26-year old) is US$133/month, compared to US$161/month for World Nomads (note that this can vary depending on certain factors).

Add-ons also include more extensive coverage for adventure sports, electronics theft, and US coverage.

They have two plans you may want to check out: Nomad Insurance (travel insurance) vs. Nomad Health (full international health insurance).

SafetyWing — General Highlights

| Duration of coverage | Can auto-renew plan, every 28 days |

| Location coverage | Covers 180+ countries |

| Equipment insurance | Can add this as an option |

| Adventure activities and sports | Included, with option for more extreme sports |

| Trustpilot Score (as of May 2024) | 3.9/5 from 1,133 reviews |

SafetyWing Nomad Insurance Plan Highlights (see full coverage):

| Nomad Insurance (USD) | |

| Medical treatment of unexpected illness/injury | Up to max limit* |

| Ambulance and emergency transportation | Up to max limit* |

| Medical evacuation | US$100K lifetime, $25K for pre-existing condition, US$5K for return ticket |

| Repatriation | US$5,000 |

| Care outside hospital | Up to max limit* |

| Emergency treatment of pre-existing condition | Up to max limit* |

| Trip interruption | US$5,000 |

| Lost check-in baggage | US$6K lifetime, US$3K per active insurance period, up to US$500 per item |

| Stolen passport or loss of travel document | US$100 |

| Adventure sports and activities (see list) | Included – can upgrade to more activities |

*Max limit refers to the maximum amount of money that you can get reimbursed for (US$250K per insurance period).

Get a quote using this price calculator:

SafetyWing Nomad Health Plan Highlights (see full coverage for Standard and Premium):

| Standard (USD) | Premium (USD) | |

| Worldwide coverage | US$1,500,000 (per Policy year) | US$1,500,000 (per Policy year) |

| Outpatient treatments | US$5,000 | US$5,000 |

| Dental treatments | Not included | US$1,500 |

| Vision-related treatments | Not included | US$500 |

| Screenings and vaccines | US$350 | US$500 |

SafetyWing’s Nomad plans cover Covid-19 treatment and quarantine.

Other highlights:

– Diagnostics

– Physical therapy

– Emergency dental treatment

– Out-of-pocket hospital expenses

– Covid-19 treatment and quarantine

3) Genki — health insurance with unlimited payouts

Genki has only been in the game since 2018, but is already one of the most-suggested health insurance for digital nomads within the community. Their plans are notable for providing unlimited payouts with worldwide coverage for approved claims.

They have three plans: the Explorer plan is their travel health insurance, suitable for trips up to two years.

The Resident plan is their international health insurance (incl. pre-existing conditions, dental, and mental health treatments), while the Resident Premium plan is the same but with more coverage.

Genki — General Highlights

| Duration of coverage | Monthly subscription plan; you can renew every 2 years (Explorer), while there is no limit for period of cover for more premium plans |

| Location coverage | Worldwide |

| Equipment insurance | Not included |

| Adventure activities and sports | Included, limited coverage (see list) |

| Trustpilot Score (as of May 2024) | 4.3/5 from 429 reviews |

Genki Explorer Plan Highlights (see full coverage):

| Explorer (EUR) | |

| Inpatient and outpatient treatment including operations | Unlimited |

| Drugs, medicines and bandages | Unlimited |

| Simple dental treatment | €500 |

| Medically-necessary dental treatment | €1,000 |

| Outpatient first-response medical care of psychological illnesses | €1,500 (3 sessions) |

| In-patient emergency medical treatment for mental and psychological disorders (first time) | €20,000 |

| Transportation costs to the next hospital | Unlimited |

| Repatriation | Unlimited |

| Medical evacuation | €150 |

Genki Resident and Resident Premium Plans Highlights (see full coverage)

| Resident (EUR) | Resident Premium (EUR) | |

| Accidents, emergencies, common medical ailments | Unlimited | Unlimited |

| Medical transportation | Unlimited | Unlimited |

| Free choice of doctors and hospitals, including telemedicine | Included | Included |

| Medical consults, examinations, procedures and surgeries | Included | Included |

| Preventive care (check-ups, vaccines, etc) | Not included | Included |

| Dental treatments | Included (see coverage for excluded treatments) | Included (see coverage for excluded treatments) |

| Transportation costs to the hospital | Unlimited | Unlimited |

| Mental health treatments | Inpatient (unlimited) and outpatient (3 sessions only) | Inpatient and outpatient (unlimited) |

| Medical evacuation | Included | Included |

| Medical return transportation to home country | €5,000 | €5,000 |

| Adventure sports and activities (see list) | Included | Included |

Genki’s Resident plans include massage treatments.

Other highlights:

– Eye treatments

– Massages

– Chiropractic treatments

– Traditional Chinese medicine

– Physiotherapy

Learn more about Genki here.

4) FWD Singapore — international health insurance for expats and Singaporeans

FWD Singapore offers international health plans tailored for expats, Singaporeans, and overseas students.

Their most basic plan covers hospitalisation, but you can upgrade your plan to include other benefits. These include outpatient, dental, vision, and maternity benefits.

FWD Singapore — General Highlights

| Duration of coverage | Annual; eligible for renewal 30 days before policy year ends |

| Location coverage | Four different coverage areas (see details) |

| Equipment insurance | Not included |

| Adventure activities and sports | Included |

| Trustpilot Score (as of May 2024) | 4.5/5 from 24,131 reviews |

FWD Singapore — Specific Highlights

| FWD International Health (SGD) | |

| Hospitalisation | S$100K – S$500K* |

| Worldwide emergency treatment | Accidents paid in full, illnesses up to S$25K |

| Hospital charges | Paid in full |

| Pre- and post-hospitalisation treatment | 90 days |

| Hospital cash benefit | S$100 – S$200* |

| Accidental death and disability | S$25K – S$500K* |

| Medical evacuation and repatriation | S$1M |

*Benefit amount depends on your plan.

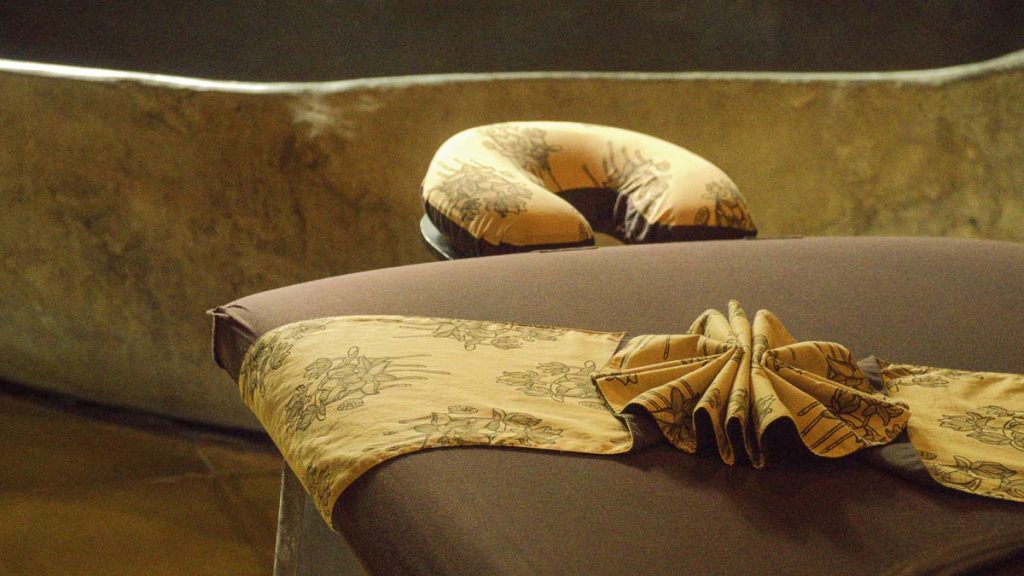

Photo credit: Nadezhda Moryak via Pexels. FWD Singapore’s higher-tier international health insurance plans cover dental treatments.

Other highlights for more premium plans (see full coverage):

– Consultations, medications, diagnostic tests

– Routine health checks and vaccinations

– Dental work

– Physiotherapy

– Frames, lenses, and eye checks every 2 years

5) MSIG TravelEasy — comprehensive medical coverage

MSIG’s TravelEasy has over 50 benefits, including Covid-19 coverage for single trips and annual plans. FYI, they have a separate plan which covers pre-existing medical conditions for single trips (TravelEasy Pre-Ex) too.

*Note: TravelEasy is a travel insurance plan and not a full health insurance.

MSIG TravelEasy — General Highlights

| Duration of coverage | Single trip or annual; can extend in the middle of a trip |

| Location coverage | Three area coverages (see Page 2 of plan brochure) |

| Equipment insurance | Not included |

| Adventure activities and sports | Included in more premium plans |

| Trustpilot Score (as of May 2024) | Not on the platform |

MSIG TravelEasy highlights (benefits listed are for adults below 70 years old):

| Standard (SGD) | Elite (SGD) | Premier (SGD) | |

| Overseas medical expenses | S$250,000 | S$500,000 | S$1,000,000 |

| Accidental death and permanent total disability | S$150,000 | S$200,000 | S$500,000 |

| Emergency medical evacuation & repatriation | S$1,000,000 | S$1,000,000 | S$1,000,000 |

| Daily benefit if hospitalised | S$100 (S$500 max) | S$100 (S$1,000 max) | S$400 (S$2,000 max) |

| Travel cancellation | S$5,000 | S$10,000 | S$15,000 |

| Travel postponement | S$750 | S$1,500 | S$2,000 |

| Trip cut short | S$5,000 | S$10,000 | S$15,000 |

| Travel disruption | S$1,000 | S$2,000 | S$3,000 |

| Stolen, lost or damaged baggage | S$3,000 | S$5,000 | S$7,500 |

| Baggage delay | S$150/6 hours ($600 max) | S$200/6 hours ($1K max) | S$250/6 hours (S$1.5K max) |

| Loss of travel documents | S$300 | S$600 | S$1,000 |

| Adventure sports and activities (see list in full policy) | Not included | Included | Included |

Learn more about the MSIG TravelEasy travel insurance.

Photo credit: Kaique Rocha via Pexels. The MSIG TravelEasy plan covers missed travel connections.

Other highlights:

– Emergency dental expenses

– Medical expenses in Singapore within 72 hours of return

– Overbooked flight and missed travel connection

– Emergency phone charges

– Compassionate and hospital visit

Steps for choosing the best travel insurance for digital nomads

Step 1: List down your priorities. Example: A super adventurous traveller will probably need a more comprehensive plan than someone who just likes sightseeing. We’re all different from one another, so make sure your plan works for you!

Step 2: Find a resource to trim down your options. Chances are you don’t know every insurance provider and plan in the market, so it’s best to seek help from someone who’s done their research, like a digital nomad group or an online article. But you’re already here, which means you’ve done this step. Hooray! 🥳

Step 3: Compare travel insurance plans. Now that you have a list of insurance providers and/or plans, check the items they cover regarding your priorities, as well as the considerations we listed in this guide. Make sure you’re qualified to avail of it as well!

Photo credit: Jason Goodman via Unsplash

Step 4: Read properly and clarify. Chances are these providers won’t tell you everything on their website, so read the full policy of your plan thoroughly. If in doubt, contact their support team for answers. This will probably save you a lot of trouble later.

Step 5: Read customer reviews. Trustpilot is a great website to check customers’ experiences. You’ll learn a lot about an insurance provider from here. Alternatively, I like checking Reddit for more authentic reviews as well. Look out for how easy and smooth a travel insurance provider’s claims process seems to be!

Step 6: Get a quote. Once you’ve made a decision, get a quote on the insurance provider’s website. They’ll connect you to an agent to jumpstart the process and answer your questions.

Read also: 9 Must-Have Remote Working Travel Essentials That Make Life Easier While on The Road

Any questions about buying travel insurance for digital nomads? Let us know in the comments below!